Turning ₹1 Crore Into a Predictable Monthly Income Stream: Hello investers, Are you planning to invest your 1 crore in mutual fund and wants to know tyhe best plan to invest? Then you are in a right place. Reaching the ₹1 crore milestone is a major financial achievement. For many investors, the next logical question is not just about growing wealth, but about converting that corpus into a stable, tax-efficient monthly income without exhausting capital too fast. This is exactly where a 1 Crore SWP Plan becomes highly relevant.

A Systematic Withdrawal Plan (SWP) allows you to invest a lump sum amount in mutual funds and withdraw a fixed amount at regular intervals, usually monthly. Unlike traditional options like fixed deposits or rental income, an SWP offers the dual advantage of regular cash flow and long-term capital growth, making it one of the most powerful income strategies for retirees, early financial independence seekers, and high-net-worth investors.

In this expert guide, we will deep dive into how a 1 crore SWP plan works, the best SWP strategy for 1 crore investment, realistic income expectations, tax implications, examples, calculators, and whether SWP is truly the best way to invest 1 crore for monthly income.

Also Check: Top 5 SWP Plans for Retired Person

What Is a 1 Crore SWP Plan?

A 1 Crore SWP Plan is an investment strategy where ₹1 crore is invested as a lump sum in selected mutual funds, and a fixed amount is withdrawn periodically to meet monthly income needs. Key features of an SWP mutual fund plan is listed below:

- Lump sum investment (₹1 crore)

- Fixed monthly withdrawals

- Remaining corpus stays invested

- Returns depend on market performance

- Withdrawals are tax-efficient compared to interest income

Unlike SIPs that focus on wealth creation, SWPs are designed for wealth distribution with sustainability.

Can I Invest 1 Crore in SWP?

Yes, absolutely. There is no upper limit on investing in SWP as long as the mutual fund scheme allows lump sum investments. Investors commonly deploy SWPs using:

- Equity mutual funds

- Hybrid (balanced advantage) funds

- Debt mutual funds

- Conservative hybrid funds

The choice of fund decides:

- Monthly withdrawal capacity

- Risk level

- Longevity of the corpus

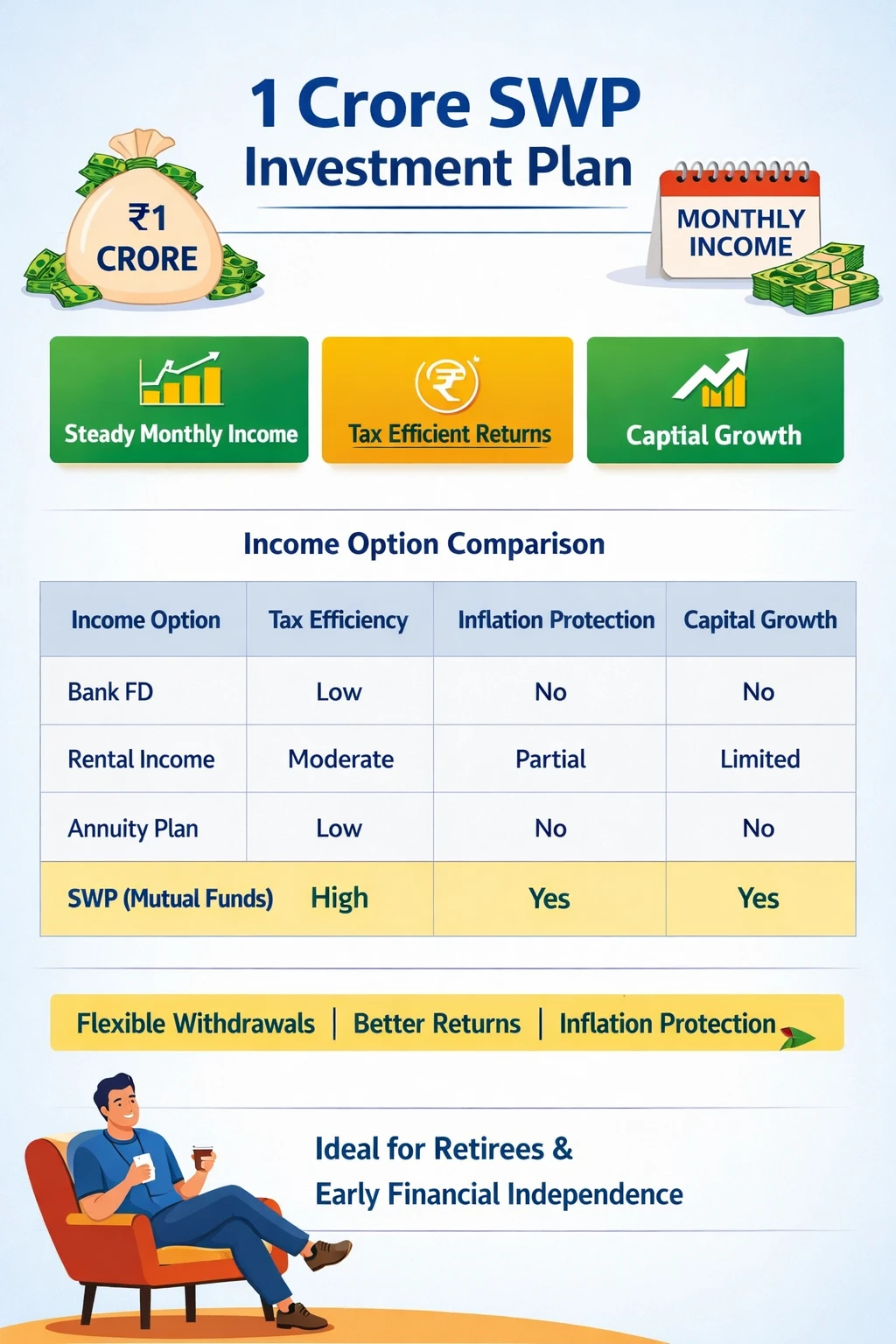

Why a 1 Crore SWP Plan Is Better Than Traditional Income Options

Comparison With Fixed Deposit, Rental Income, and Annuities

| Income Option | Monthly Income | Tax Efficiency | Inflation Protection | Capital Growth |

|---|---|---|---|---|

| Bank FD | Moderate | Low | No | No |

| Rental Income | Variable | Moderate | Partial | Limited |

| Annuity Plan | Fixed | Low | No | No |

| SWP (Mutual Funds) | Flexible | High | Yes | Yes |

A well-structured best SWP plan for 1 crore can deliver income while still allowing capital appreciation, which traditional instruments fail to provide.

Best SWP Plan for 1 Crore: Ideal Asset Allocation

There is no one-size-fits-all solution. The best SWP plan for 1 crore depends on your:

- Age

- Risk tolerance

- Monthly income requirement

- Investment horizon

Recommended Asset Allocation Models

Conservative SWP Strategy

- 70% Debt funds

- 30% Hybrid funds

- Suitable for retirees seeking stability

Balanced SWP Strategy

- 40% Equity funds

- 40% Hybrid funds

- 20% Debt funds

- Ideal for long-term income with growth

Growth-Oriented SWP Strategy

- 60% Equity funds

- 25% Hybrid funds

- 15% Debt funds

- Suitable for early retirees and FIRE investors

This asset mix ensures that withdrawals are funded partly by returns rather than principal erosion.

1 Crore SWP Strategy: How Much Monthly Income Is Possible?

The biggest attraction of a 1 crore SWP plan is predictable monthly income. But expectations must be realistic.

Common Monthly Withdrawal Scenarios

| Monthly Withdrawal | Annual Withdrawal | Sustainability |

| ₹40,000 | ₹4.8 lakh | Very High |

| ₹60,000 | ₹7.2 lakh | High |

| ₹80,000 | ₹9.6 lakh | Moderate |

| ₹1,00,000 | ₹12 lakh | Depends on returns |

With an average long-term return of 8–10%, a ₹60,000–₹80,000 monthly SWP is generally sustainable without eroding capital aggressively.

1 Crore SWP Plan Example (Practical Scenario)

Let us understand this with a realistic example.

- Investment Amount: ₹1 crore

- Expected Return: 9% annually

- Monthly SWP: ₹75,000

- Annual Withdrawal: ₹9 lakh

Over the first few years:

- Monthly income remains stable

- Part of withdrawal comes from gains

- Remaining corpus continues compounding

With disciplined withdrawals, the investor may still retain a significant portion of the original capital even after 15–20 years.

This makes the 1 crore SWP plan example highly attractive for retirement income planning.

1 Crore SWP Plan Calculator: Why It Matters

A 1 crore SWP plan calculator helps investors:

- Estimate sustainable monthly withdrawals

- Check corpus longevity

- Adjust withdrawals for inflation

- Compare different return assumptions

Using a calculator before starting SWP prevents over-withdrawal, which is the biggest risk in SWP planning.

Many investors also use a 1 crore SWP plan Excel sheet to track:

- Monthly NAV changes

- Capital gains taxation

- Remaining corpus value

Taxation in a 1 Crore SWP Plan

Tax efficiency is one of the biggest reasons SWP beats FD income.

How SWP Tax Works?

- Only the capital gains portion of each withdrawal is taxed

- Principal portion is tax-free

- Long-term capital gains are taxed at lower rates

Tax Impact by Fund Type

| Fund Type | Holding Period | Tax Rate |

| Equity Funds | Over 1 year | 10% on gains |

| Hybrid Funds | Depends on equity exposure | Mixed |

| Debt Funds | As per slab (post indexation rules) | Slab rate |

Compared to FD interest taxed fully every year, SWP taxation is far more efficient.

What Is the Best Way to Invest 1 Crore?

If your goal is monthly income + capital preservation, SWP stands out as one of the best ways to invest 1 crore.

However, an ideal strategy could include:

- SWP for income

- A portion in growth funds

- Emergency liquidity in short-term debt funds

Pure FDs may feel safe but lose purchasing power over time due to inflation.

How Do I Double My 1 Crore While Using SWP?

Doubling ₹1 crore while withdrawing income is challenging but possible with:

- Moderate withdrawal rate

- Equity-oriented allocation

- Long-term horizon (15+ years)

- Inflation-adjusted withdrawal increases

A low initial SWP combined with equity exposure allows compounding to work even while generating income.

Common Mistakes to Avoid in a 1 Crore SWP Plan

- Withdrawing too aggressively early

- Ignoring inflation impact

- Choosing only debt funds

- Not rebalancing portfolio

- Skipping periodic review

A disciplined strategy ensures your SWP lasts longer and performs better.

FAQs on 1 Crore SWP Plan

1. Is SWP better than FD for monthly income?

- Yes, SWP is more tax-efficient and offers inflation protection, unlike FDs.

2. Can SWP income increase every year?

- Yes, withdrawals can be increased gradually to beat inflation.

3. Is SWP risky?

- Market volatility affects returns, but proper asset allocation reduces risk significantly.

4. Can I stop or modify SWP anytime?

- Yes, SWP is flexible and can be modified or stopped anytime.

5. Is SWP suitable for early retirement?

- Absolutely. Many FIRE investors use SWP as their primary income strategy.

Final Thoughts:

A 1 Crore SWP Plan is one of the most powerful and flexible strategies for generating regular monthly income without sacrificing long-term wealth creation. When designed correctly, it allows investors to enjoy consistent cash flow, benefit from market growth, and manage taxes efficiently. Unlike traditional income options that either lock your money or fail to beat inflation, SWP keeps your capital working while meeting your lifestyle needs.

Whether you are planning retirement, pursuing early financial independence, or simply looking for a smarter way to deploy a large corpus, a well-structured SWP strategy backed by diversified mutual funds can deliver stability, growth, and peace of mind.

The key lies in realistic withdrawal expectations, proper asset allocation, and periodic review. For investors seeking sustainable income with flexibility, the 1 crore SWP plan truly stands out as one of the best investment plans available today. Follow us for more investement tips and strategies. Thanks for your visit.

Tags: best swp plan for 1 crore, Can I invest 1 crore in SWP? 1 crore swp strategy, 1 crore swp plan calculator, 1 crore swp plan example, 1 crore swp plan excel, What is the best way to invest 1 crore? How do I double my 1 crore?