SIP vs SWP: When it comes to mutual fund investing in India, two strategies dominate almost every serious financial discussion: SIP and SWP. Investors often ask, SIP vs SWP which is better?, Is SWP better than SIP?, or SIP or SWP which is better in India for long-term wealth and retirement income?

The truth is, SIP and SWP are not rivals. They serve very different financial purposes at different stages of life. SIP helps you build wealth, while SWP helps you use that wealth efficiently. Unfortunately, most online articles stop at basic definitions and fail to explain real-life use cases, risks, taxation impact, and practical examples.

In this in-depth guide, written from the perspective of a mutual fund and SWP expert, you’ll get a clear, honest, and practical comparison of SIP vs SWP, complete with examples, advantages, disadvantages, and decision frameworks to help you choose what truly fits your goals.

What Is SIP? Systematic Investment Plan Explained Simply

A Systematic Investment Plan (SIP) is a disciplined way of investing a fixed amount regularly (monthly, quarterly, or weekly) into a mutual fund scheme.

How SIP Works

- You invest a fixed amount at regular intervals

- Units are bought at different market levels

- You benefit from rupee cost averaging

- Long-term compounding drives wealth creation

Who Should Choose SIP?

- Salaried individuals

- First-time investors

- Long-term wealth creators

- People saving for goals like retirement, child education, or home purchase

Key Benefits of SIP

- Disciplined investing habit

- Lower impact of market volatility

- Power of compounding over time

- Affordable entry into equity markets

SIP is best when your goal is accumulation, not income.

What Is SWP? Systematic Withdrawal Plan Explained Clearly

A Systematic Withdrawal Plan (SWP) allows you to withdraw a fixed amount regularly from your invested mutual fund corpus.

How SWP Works

- You invest a lump sum or accumulated corpus

- You withdraw a fixed amount monthly, quarterly, or annually

- Remaining corpus stays invested and continues to earn returns

Who Should Choose SWP?

- Retirees

- Individuals seeking regular income

- Investors with a large lump sum

- People looking for tax-efficient withdrawals

Key Benefits of SWP

- Regular predictable cash flow

- Better tax efficiency than fixed deposits

- Inflation-adjusted withdrawal options

- Capital remains invested

SWP is ideal for income generation, especially post-retirement.

SIP vs SWP: Core Conceptual Difference

At its core, the difference between SIP and SWP is simple:

- SIP = Investing money regularly

- SWP = Withdrawing money regularly

But in practice, the difference goes much deeper.

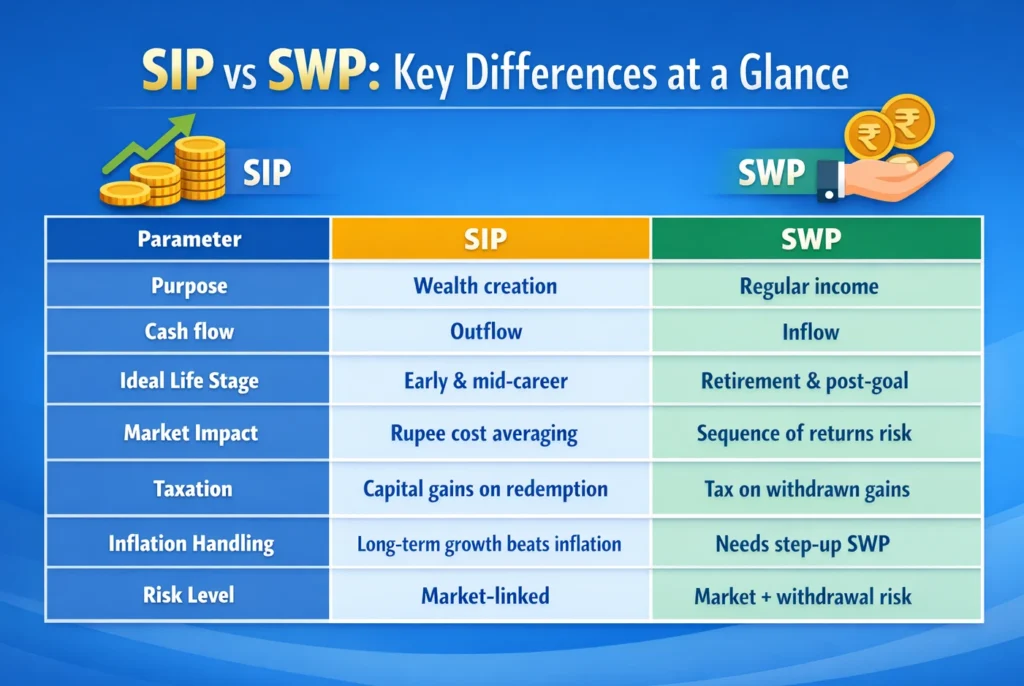

SIP vs SWP: Key Differences at a Glance

| Parameter | SIP | SWP |

| Purpose | Wealth creation | Regular income |

| Cash flow | Outflow | Inflow |

| Ideal life stage | Early & mid-career | Retirement & post-goal |

| Market impact | Rupee cost averaging | Sequence of returns risk |

| Taxation | Capital gains on redemption | Tax on withdrawn gains |

| Inflation handling | Long-term growth beats inflation | Needs step-up SWP |

| Risk level | Market-linked | Market + withdrawal risk |

Difference Between SIP and SWP With Example

SIP Example

- Monthly SIP: ₹10,000

- Investment period: 20 years

- Expected return: 12% annually

- Total investment: ₹24 lakh

- Approx corpus: ₹1 crore+

Here, SIP builds wealth over time using compounding.

SWP Example

- Total corpus: ₹1 crore

- Monthly SWP: ₹40,000

- Expected return: 8% annually

- Withdrawal duration: 20–25 years (depending on market performance)

Here, SWP converts accumulated wealth into steady income.

This example clearly shows SIP builds the corpus, SWP consumes it wisely.

SIP or SWP Which Is Better in India?

The answer depends on your financial stage and goal, not on the product itself.

SIP Is Better If:

- You are earning regularly

- You are below retirement age

- You want long-term wealth

- You can tolerate short-term market volatility

SWP Is Better If:

- You need regular income

- You are retired or semi-retired

- You already have a lump sum

- You want tax-efficient withdrawals

So, asking SIP vs SWP which is best without context leads to wrong decisions.

Is SWP Better Than SIP?

SWP is not better than SIP by default. SWP becomes powerful only after SIP or lump sum investing has already built wealth.

Think of SIP as filling a water tank and SWP as drawing water slowly so it lasts longer.

Using SWP without a proper corpus is risky. Using SIP without an exit strategy is incomplete.

Is SWP 100% Safe?

No, SWP is not 100% safe, especially when linked to equity or hybrid funds.

Risks in SWP

- Market downturns can reduce corpus

- High withdrawal rates can exhaust capital

- Poor fund selection increases volatility

- Inflation can erode real income

However, when:

- Withdrawal rate is reasonable

- Fund allocation is conservative

- SWP is inflation-adjusted

SWP becomes relatively stable and sustainable, though never risk-free.

How Much SWP for 10 Lakh?

For a ₹10 lakh corpus, a safe SWP depends on asset allocation and return expectations.

Conservative SWP Guidelines

- Monthly SWP: ₹3,000 to ₹5,000

- Annual withdrawal rate: 4% to 6%

- Fund type: Conservative hybrid or debt-oriented funds

Higher withdrawals increase the risk of capital depletion. This is why disciplined planning is critical.

SIP vs SWP SBI Mutual Funds – Practical Perspective

In popular fund houses like SBI Mutual Fund, both SIP and SWP are widely used:

- SIPs are commonly used in equity and hybrid funds for long-term growth

- SWPs are popular in hybrid and debt funds for retirement income

The strategy matters more than the fund house. A poorly planned SWP in any fund can fail, while a well-structured SIP can succeed across fund houses.

What Are the Disadvantages of SWP?

While SWP is powerful, it has limitations.

- Capital erosion if withdrawals are too high

- Market volatility impacts sustainability

- Requires active monitoring

- Not suitable for short-term aggressive withdrawals

- Inflation can reduce purchasing power if not adjusted

Understanding these disadvantages helps investors avoid unrealistic expectations.

SIP vs SWP Which Is Best:

Ask yourself these questions:

- Are you investing or withdrawing?

- Do you need income today or wealth tomorrow?

- Can you handle market volatility?

- Do you already have a large corpus?

Simple Rule

- Earning phase = SIP

- Retirement phase = SWP

- Transition phase = SIP + SWP combined

FAQs on SIP vs SWP

1. SIP or SWP which is better in India?

- SIP is better for wealth creation, while SWP is better for regular income. The choice depends on your financial goal and life stage.

2. Difference between SIP and SWP with example?

- SIP involves investing regularly to build wealth, while SWP involves withdrawing regularly from an existing corpus for income.

3. Is SWP better than SIP?

- SWP is better only when you already have a sufficient corpus and need income. SIP is better during the accumulation phase.

4. Is SWP 100% safe?

- No, SWP carries market risk and withdrawal risk, though conservative planning can reduce volatility.

5. How much SWP for 10 lakh?

- A safe monthly SWP from ₹10 lakh is usually ₹3,000–₹5,000 depending on returns and asset allocation.

6. What are the disadvantages of SWP?

- Market risk, capital erosion, inflation impact, and the need for disciplined withdrawal planning.

Conclusion – SIP vs SWP Is Not a Battle, It’s a Strategy

The debate around SIP vs SWP which is better often misses the bigger picture. SIP and SWP are not competing products but complementary financial tools designed for different phases of your financial journey. SIP is your wealth engine, silently working in the background through disciplined investing, rupee cost averaging, and compounding over long periods.

SWP, on the other hand, is your income engine, converting accumulated wealth into predictable cash flow while keeping the remaining corpus invested. In India, where inflation and longevity are real challenges, relying only on SIP without a withdrawal strategy or using SWP without a solid corpus can lead to financial stress. A smart investor understands when to invest aggressively, when to shift to stability, and how to balance growth with income.

The most successful financial plans use SIP during earning years, transition gradually, and deploy SWP during retirement or income phases. When aligned with goals, risk tolerance, and timelines, SIP and SWP together create a powerful, sustainable, and stress-free financial ecosystem rather than an either-or choice. If you have any questions on SIP or SWP please feel free to ask in the below comment section. Thanks for your visit.

Tags: SIP or SWP which is better in India, Difference between SIP and SWP with example, Is SWP better than SIP? Is SWP 100% safe? How much SWP for 10 lakh? sip vs swp which is best, What are the disadvantages of SWP? Sip vs swp sbi.