SIP to SWP Conversion: Most mutual fund investors begin their journey with a clear objective: disciplined wealth creation. Systematic Investment Plans (SIPs) are designed precisely for this purpose. But as life goals evolve, so does the need for money. Retirement, regular monthly income, children’s education, or financial independence often demand a steady cash flow rather than continued accumulation.

This is where SIP to SWP Conversion becomes one of the smartest transitions in personal finance. Investors frequently ask questions like Can SIP convert into SWP?, How to start SWP after SIP?, or Is it possible to convert SIP to SWP without selling everything? The answer is yes, and when done correctly, this transition can be both tax-efficient and financially stable.

In this in-depth guide, I’ll explain how SIP to SWP transition works, when it makes sense, step-by-step conversion methods, taxation rules, platform-specific insights like Zerodha, and common mistakes to avoid. This article is written from the perspective of a mutual fund and SWP planning expert, focusing on long-term sustainability rather than short-term gains.

Also Check: How to retire in your 30s using SIP and SWP?

Understanding SIP and SWP before Conversion

What is SIP?

A SIP, or Systematic Investment Plan, allows investors to invest a fixed amount at regular intervals into a mutual fund. It is primarily used for:

- Long-term wealth creation

- Rupee cost averaging

- Disciplined investing

- Compounding benefits

SIPs are most effective during the accumulation phase of your financial life.

What is SWP?

An SWP, or Systematic Withdrawal Plan, does the opposite. Instead of investing money periodically, you withdraw a fixed amount from your mutual fund investment at regular intervals. SWP is mainly used for:

- Regular income generation

- Retirement planning

- Tax-efficient withdrawals

- Controlled redemption strategy

The SIP to SWP conversion essentially marks the shift from accumulation to income generation.

SIP to SWP Conversion Explained

Can SIP Convert into SWP?

Yes, SIP can be converted into SWP, but not directly in a single click. SIP and SWP are separate facilities. What you actually do is:

- Stop your SIP once the accumulation goal is achieved

- Allow the invested corpus to remain in the mutual fund

- Start an SWP from the same fund using the accumulated amount

This process is commonly referred to as switch SIP to SWP, though technically it is a structured transition rather than a fund switch.

Is It Possible to Convert SIP to SWP in the Same Fund?

Absolutely. Most investors prefer starting SWP in the same fund where SIP was running, especially if the fund has performed consistently and matches income needs. This avoids unnecessary exit and re-entry risks.

Why SIP to SWP Transition Makes Financial Sense?

The SIP to SWP transition is not just about withdrawing money. It’s about optimizing returns, taxation, and longevity of capital.

Key Benefits of SIP to SWP Conversion

- Converts long-term wealth into predictable income

- More tax-efficient than dividend options

- Allows remaining corpus to stay invested and grow

- Reduces sequence-of-returns risk when planned correctly

- Provides flexibility to adjust withdrawal amount

When planned properly, SWP can outlast traditional fixed income instruments.

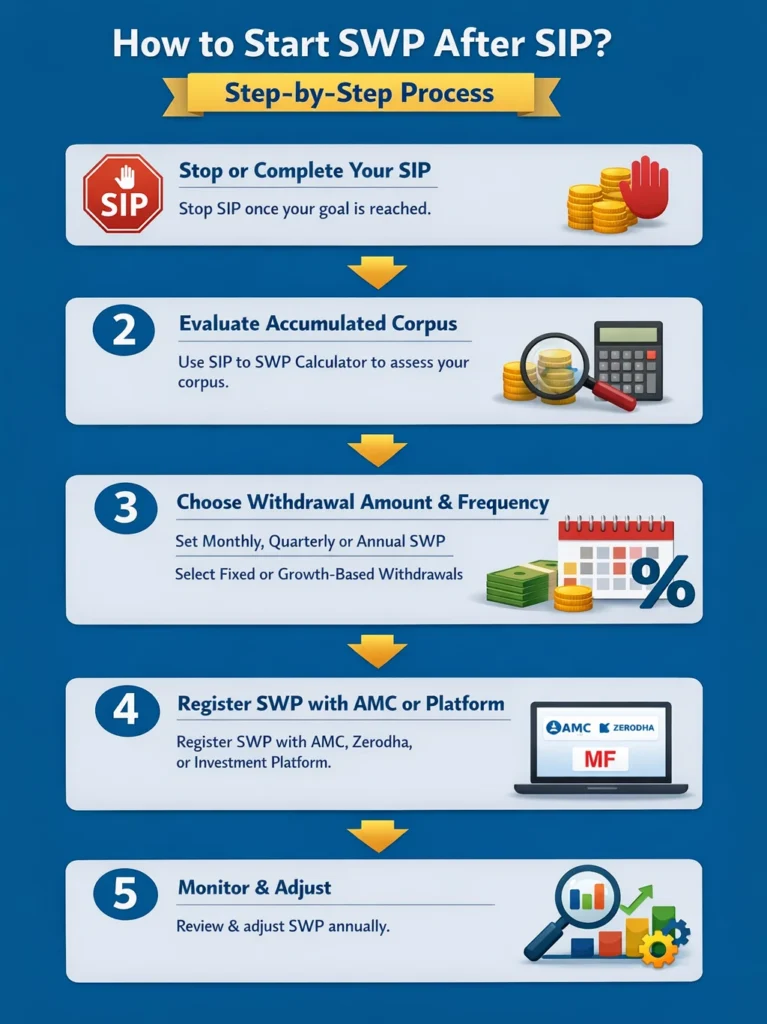

How to Start SWP after SIP? – Step-by-Step Process

Step 1: Stop or Complete Your SIP

Once your SIP goal is achieved or you reach the income phase, stop further SIP installments. There is no penalty for stopping SIPs.

Step 2: Evaluate the Accumulated Corpus

Assess whether your total investment can support regular withdrawals. This is where a SIP to SWP calculator becomes extremely useful, as it helps determine sustainable withdrawal amounts.

Step 3: Choose Withdrawal Amount and Frequency

You can select:

- Monthly, quarterly, or annual SWP

- Fixed amount or capital appreciation-based withdrawals

Monthly SWP is most common for salary-like income.

Step 4: Register SWP with AMC or Platform

You can start SWP through:

- AMC website

- Registrar platforms

- Investment platforms like Zerodha

Step 5: Monitor and Adjust

SWP is not a set-and-forget strategy. Annual review is essential to adjust for inflation and market performance.

SIP to SWP Conversion Example (Simple Table)

| Parameter | SIP Phase | SWP Phase |

| Objective | Wealth creation | Income generation |

| Cash flow | Outflow | Inflow |

| Investment style | Accumulation | Distribution |

| Tax impact | No tax during SIP | Capital gains tax on withdrawals |

| Best suited for | Working years | Retirement or passive income |

How to Convert SIP to SWP in Zerodha?

SIP to SWP Conversion in Zerodha Coin

Many investors ask, How to convert SIP to SWP Zerodha? The process is simple:

- Stop the active SIP from your Zerodha Coin dashboard

- Ensure your mutual fund units are available

- Select the SWP option under mutual fund actions

- Enter withdrawal amount, frequency, and start date

- Confirm mandate

Zerodha does not auto-convert SIP to SWP, so this manual setup is necessary.

SIP to SWP Calculator: Why It’s Critical

A SIP to SWP calculator helps you determine:

- How long your corpus will last

- Ideal withdrawal amount

- Impact of market returns on sustainability

Without calculator-based planning, investors often withdraw too aggressively, leading to capital erosion.

Using a calculator helps align SWP withdrawals with realistic return assumptions rather than optimistic projections.

Which Is More Profitable, SIP or SWP?

This is one of the most misunderstood questions in investing.

SIP vs SWP: Profitability Perspective

- SIP is more profitable during accumulation because it benefits from compounding

- SWP is not designed to maximize returns but to provide income

- Profitability depends on goal, not comparison

SIP builds wealth. SWP distributes it. Comparing them directly is incorrect because they serve different financial phases.

Taxation in SIP to SWP Conversion

Is SIP to SWP Taxable?

There is no tax when stopping SIP or starting SWP. Tax applies only on each SWP withdrawal. You can use our swp tax calculator to plan your swp investment.

How Are SWP Withdrawals Taxed?

- Equity funds: Long-term capital gains above exemption are taxed at applicable rates

- Debt funds: Taxed as per holding period rules

- Only the gains portion of each withdrawal is taxable

This makes SWP far more tax-efficient than withdrawing lump sums.

Common Mistakes to Avoid During SIP to SWP Conversion

- Starting SWP too early before corpus matures

- Ignoring inflation while fixing withdrawal amount

- Withdrawing more than sustainable return

- Not rebalancing fund allocation

- Treating SWP like guaranteed income

Avoiding these mistakes can significantly improve the lifespan of your investment.

FAQs on SIP to SWP Conversion

1. Can SIP convert into SWP automatically?

- No, SIP does not automatically convert into SWP. You must manually stop SIP and initiate SWP.

2. Is it possible to convert SIP to SWP without selling units?

- Yes, SWP withdraws units periodically without liquidating the entire investment at once.

3. How to start SWP after SIP completion?

- Once SIP stops, register an SWP using your accumulated corpus through AMC or investment platform.

4. Is SIP to SWP conversion good for retirement?

- Yes, it is one of the most effective retirement income strategies when planned conservatively.

5. Does SIP to SWP transition reduce returns?

- Returns may appear lower because money is withdrawn, but remaining units continue to grow.

Final Words:

SIP to SWP Conversion is not merely a technical switch; it is a strategic financial transition that reflects maturity in investment planning. SIP helps you build wealth systematically during your earning years, while SWP allows you to extract that wealth efficiently when income becomes a priority. When done thoughtfully, this transition ensures financial independence without exhausting your capital prematurely.

A well-planned SIP to SWP transition balances growth, income, and taxation. It requires realistic expectations, correct withdrawal rates, and periodic reviews. Tools like SIP to SWP calculators, platform-based execution such as Zerodha, and a clear understanding of taxation can significantly improve outcomes. Instead of withdrawing lump sums or relying solely on fixed deposits, SWP offers flexibility, control, and long-term sustainability.

Ultimately, SIP and SWP are not competitors. They are complementary phases of the same investment journey. Mastering SIP to SWP conversion means you are not just investing smartly but also withdrawing wisely, ensuring your money works for you at every stage of life.

I hope the above guide will help you to transfer your mutual fund investment from SIP to SWP monthly income easily. If you still have any questions about sip to swp conversion please feel free to contact us. Follow for more investment related tips and thanks for your visit.

Tags: Can SIP convert into SWP? How to start SWP after SIP? Which is more profitable, SIP or SWP? How to convert SIP to swp zerodha? Sip to swp calculator, sip to swp transition switch sip to swp, Is it possible to convert SIP to SWP?