SWP Disadvantages: Systematic Withdrawal Plan (SWP) is often projected as the perfect income solution for retirees and passive income seekers. Regular monthly cash flow, tax efficiency, and flexibility make SWP sound almost flawless. However, as a mutual fund and SIP expert who has seen multiple market cycles, I can confidently say one thing: SWP is powerful, but it is not risk-free.

Many investors enter SWPs without fully understanding the downside. They focus only on income and ignore how withdrawals interact with market volatility, inflation, and portfolio sustainability. This article is written to close that knowledge gap.

In this deep-dive guide, we will uncover SWP disadvantages, real-world risks, common mistakes, and situations where SWP may actually hurt your wealth instead of protecting it. If you are planning SWP in 2026, this article is a must-read.

Also Check: Is SWP Risk free?

What Is an SWP in Mutual Funds? (Quick Recap)

A Systematic Withdrawal Plan allows investors to withdraw a fixed amount at regular intervals from a mutual fund investment. The withdrawals can be monthly, quarterly, or annually.

SWP is commonly used for:

- Retirement income

- Post-goal income planning

- Creating predictable cash flow

- Tax-efficient withdrawals

But beneath this simplicity lie multiple hidden risks that most investors overlook. Before starting withdrawals, it’s wise to check your expected income and sustainability using an SWP calculator.

SWP Disadvantages in Mutual Fund – The Reality Investors Ignore

Let us break down the real disadvantages of SWP with expert clarity.

1. Sequence of Returns Risk – The Biggest SWP Threat

One of the most underestimated SWP drawbacks is sequence of returns risk. When markets fall early during your SWP period, your withdrawals happen at lower NAVs. This forces you to redeem more units, permanently damaging your portfolio.

Why this is dangerous:

- Early losses are irreversible

- Units redeemed during crashes are gone forever

- Recovery later may not rebuild lost units

This risk is especially severe in:

- Equity mutual funds

- Hybrid funds with higher equity exposure

- Aggressive withdrawal rates

This single factor alone can turn SWP from a wealth preserver into a wealth destroyer.

2. Capital Erosion Risk in Market Downturns

Another major disadvantage of SWP in mutual funds is capital erosion.

If your withdrawal amount is:

- Higher than portfolio returns

- Not adjusted for market cycles

- Started without a buffer corpus

Then your principal will gradually shrink.

Many investors wrongly assume: “As long as I get monthly income, my capital is safe.”

In reality:

- Markets do not deliver linear returns

- Continuous withdrawals during volatility eat into capital

- Long bear markets can permanently shrink your corpus

This makes SWP risky when used without conservative planning.

3. Inflation Risk – SWP Income Loses Real Value

SWP provides fixed cash flow, but inflation keeps rising. A ₹50,000 monthly SWP today may feel sufficient, but after 8–10 years:

- Purchasing power reduces sharply

- Medical and lifestyle costs rise faster than inflation

- Fixed withdrawals fail to match real expenses

Unless your SWP amount grows periodically, inflation silently erodes your lifestyle. This is one of the most ignored SWP disadvantages in long-term income planning.

4. Not All Mutual Funds Are Suitable for SWP

Choosing the wrong fund is one of the biggest SWP mistakes investors make.

SWP is often started in:

- High-risk equity funds

- Sectoral or thematic funds

- Small-cap heavy portfolios

Why this is dangerous:

- High volatility increases unit erosion

- Returns become unpredictable

- Income stability is compromised

SWP requires stability, not aggressive growth. Fund mismatch can severely amplify risk.

5. Overconfidence in Tax Efficiency

Yes, SWP is tax-efficient. But tax efficiency does not eliminate risk.

Common misconceptions:

- “SWP tax is always low”

- “I pay tax only on gains, so it is safe”

- “Better than FD, so no downside”

Reality:

- Tax benefit does not protect capital

- Market losses outweigh tax savings

- Long-term capital gains tax still applies

Tax efficiency should be a bonus, not the primary reason to start SWP.

6. Fixed SWP Amount Can Be a Strategic Mistake

Many investors lock themselves into a fixed withdrawal amount without flexibility.

Problems with fixed SWP:

- Does not adapt to market conditions

- Withdraws aggressively during downturns

- Misses opportunity to reduce withdrawals temporarily

Smart SWP planning requires dynamic withdrawal strategies, which most investors ignore.

7. Psychological Risk – False Sense of Security

Regular monthly income creates emotional comfort. But this comfort can be dangerous.

Investors often:

- Stop monitoring portfolio performance

- Ignore NAV trends

- Continue SWP even during extended market stress

This emotional detachment leads to delayed corrective actions and long-term damage.

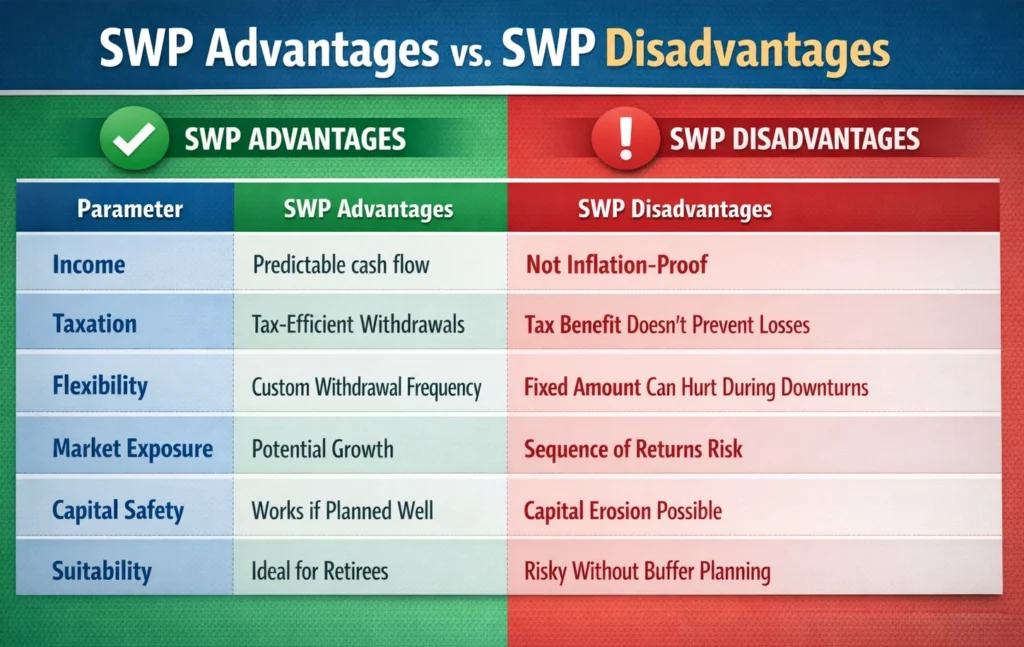

SWP Advantages and Disadvantages – Quick Comparison

| Parameter | SWP Advantages | SWP Disadvantages |

| Income | Predictable cash flow | Not inflation-proof |

| Taxation | Tax-efficient withdrawals | Tax benefit doesn’t prevent losses |

| Flexibility | Custom withdrawal frequency | Fixed amount can hurt during downturns |

| Market exposure | Potential growth | Sequence of returns risk |

| Capital safety | Works if planned well | Capital erosion possible |

| Suitability | Ideal for retirees | Risky without buffer planning |

Is There Any Risk in SWP? Absolutely Yes

To answer clearly: Yes, there is risk in SWP.

Key risks include:

- Market volatility risk

- Withdrawal timing risk

- Longevity risk (outliving your corpus)

- Inflation risk

- Fund selection risk

SWP is not bad, but it is not a guaranteed income product.

What Are the Risks of SWP During Volatile Markets?

In volatile markets:

- NAV fluctuates sharply

- More units are redeemed during falls

- Recovery becomes slower due to reduced unit base

This makes SWP especially risky during:

- Bear markets

- High interest rate cycles

- Global economic uncertainty

SWP Is Good or Bad? The Expert Verdict

SWP is neither good nor bad by default.

SWP is good when:

- Withdrawal rate is conservative

- Fund selection is stable

- Inflation is factored in

- Portfolio is monitored annually

SWP is bad when:

- Withdrawals exceed sustainable returns

- No buffer corpus is maintained

- High-risk funds are used

- Investor ignores market cycles

Common SWP Mistakes Investors Must Avoid

Here are the most damaging SWP mistakes:

- Starting SWP immediately after investing

- Using equity-heavy funds without buffer

- Ignoring inflation adjustment

- Setting unrealistic withdrawal expectations

- Never reviewing SWP strategy

Avoiding these mistakes alone can dramatically improve SWP success.

Pros and Cons of SWP – Balanced View

Pros

- Regular income

- Better tax efficiency than dividends

- Flexibility in withdrawals

- Control over cash flow

Cons

- Capital erosion risk

- Sequence of returns risk

- Inflation impact

- Fund selection sensitivity

- Emotional complacency

FAQs on SWP Disadvantages in Mutual Fund

1. Is SWP safe for retirement?

- SWP can be safe if withdrawals are conservative, funds are stable, and inflation is planned for. Otherwise, it can be risky.

2. Can SWP exhaust my investment?

- Yes, If withdrawals exceed portfolio returns or market conditions remain weak, your corpus can deplete fully.

3. Is SWP better than dividend option?

- Yes in tax efficiency, but both carry market risk. SWP offers better control but not guaranteed safety.

4. Should SWP be stopped during market crashes?

- Not always, but withdrawal reduction or temporary pause may help protect capital.

Is SWP suitable for long-term income?

- Only if inflation-adjusted and reviewed periodically. Fixed SWP for decades is risky.

Final Words:

SWP is a sophisticated income strategy, not a magic income machine. The biggest mistake investors make is assuming that regular withdrawals mean safety. In reality, SWP amplifies both discipline and mistakes. When planned properly, SWP can provide stable, tax-efficient income while preserving wealth. But when misunderstood, it quietly erodes capital through poor timing, inflation neglect, and emotional complacency.

In 2026, with markets expected to remain volatile and interest rate cycles uncertain, understanding SWP disadvantages becomes more critical than ever. Investors must focus on sustainable withdrawal rates, conservative fund selection, periodic reviews, and inflation-linked adjustments.

SWP is not about maximizing income today, but about ensuring income longevity tomorrow. Treat it as a long-term financial system, not a shortcut to monthly cash flow, and it can work beautifully. Ignore its risks, and it may fail silently when you need it the most.

I hope the above guide will guide you to choose the best investment plan for your retirements. If you still have any queries about mutual fund plans please feel free to ask in the below comment section. Thanks for your visit Guys.

Tags: Is there any risk in SWP? Swp disadvantages in mutual fund, What are the risks of SWP? SWP advantages and disadvantages, SWP is good or bad, swp drawbacks, pros and cons of swp, disadvantages of swp, swp mistakes.