What is 7 5 3 1 Rule in SIP: Hello my friend, Are you really wants to know the SIP mutual fund rules to make a good profit on your investments? Then you are in a right place. If you have ever started a SIP with big dreams (buying a home, building a retirement corpus, or hitting your “₹1 crore goal”), you already know the hardest part is not selecting a fund. It is staying consistent when markets get boring, scary, or confusing.

That’s exactly why the 7 5 3 1 Rule in SIP has become one of the most practical frameworks for long-term mutual fund investors. It’s not a magic trick, and it’s not a guaranteed-return formula. But it is a simple discipline-based strategy that can dramatically improve your chances of building real wealth through SIPs.

In this post, I’ll break the rule down clearly, show you how to apply it step-by-step, and cover the common doubts like “Which SIP gives 30% return?” and “How to make 1 crore in 5 years in SIP?” in a realistic expert perspective. Read the complete post and start your investment on SIP. Okay, let’s get into the topic below.

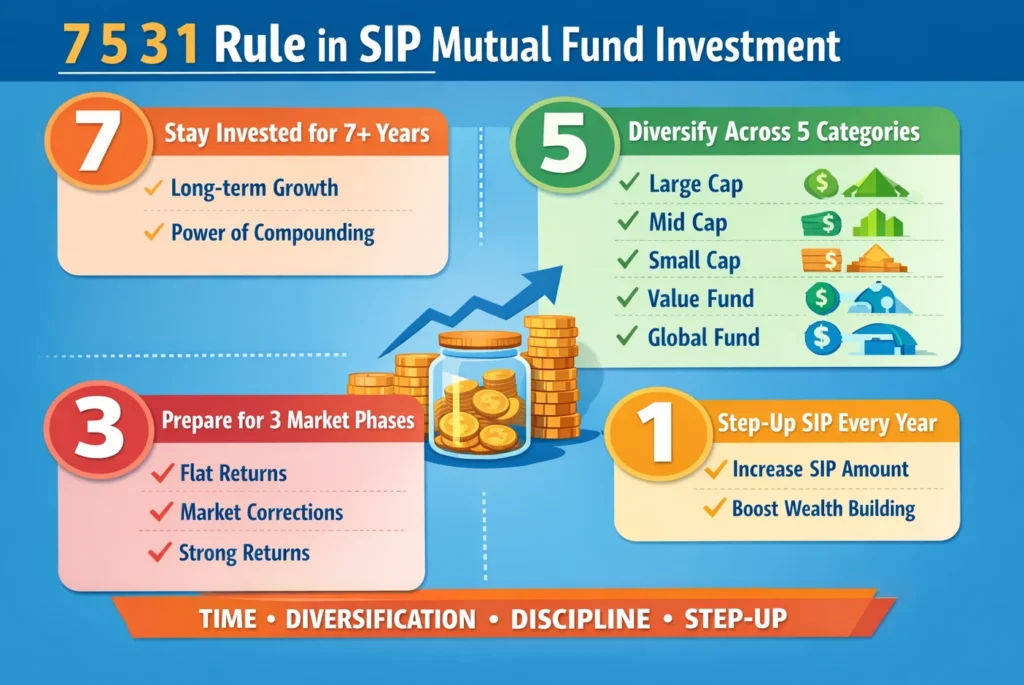

What is the 7 5 3 1 Rule in SIP?

The 7 5 3 1 Rule in SIP is a long-term investing framework designed to help SIP investors build wealth with better stability and clarity.

It basically means:

- 7 = Stay invested for at least 7 years

- 5 = Diversify across 5 categories (fund styles/segments)

- 3 = Be mentally prepared for 3 phases of market returns

- 1 = Increase SIP amount by at least 1 step-up every year

This approach is widely discussed as a “smart SIP discipline rule” because it focuses on the four pillars that actually create SIP success: time, diversification, mindset, and step-up.

Also Check: How to Switch SIP to SWP Mutual Fund?

Why the 7 5 3 1 Rule Works So Well for SIP Investors?

SIP investing is not only about returns. It’s about surviving long enough to allow compounding to do the heavy lifting.

Many people fail not because SIPs don’t work, but because they:

- Stop investing too early

- Panic during market crashes

- Put all money into one category

- Never increase SIP amount with income growth

The 7 5 3 1 Rule fixes these issues by giving you a simple rulebook to follow even when emotions are high.

Breakdown of the 7 5 3 1 Rule in SIP (Deep Explanation)

1) The “7” in 7 5 3 1 Rule: Stay Invested for Minimum 7 Years

The first and most important part is staying invested for at least 7 years, especially if your SIP is in equity mutual funds.

Why 7 years?

Because equity markets are volatile in the short term. But over longer periods, they tend to reward patience and consistency. A 7+ year horizon gives your SIP enough runway to recover from downturns and benefit from compounding.

Key takeaways of “7 years”:

- Less stress from short-term volatility

- Better probability of positive outcomes

- Higher chance of beating inflation

- More impact of compounding on your corpus

Expert tip: If your goal is 10–15 years away (like retirement or child education), the rule becomes even more powerful.

2) The “5” in 7 5 3 1 Rule: Diversify Across 5 Categories

The “5” part is about diversification. Instead of running your full SIP into one fund type, spread it intelligently across multiple categories. Different sources define the “5 categories” slightly differently, but the core idea remains the same: avoid over-dependence on one style.

Here are common “5-category” structures SIP investors use:

- Large-cap / Flexi-cap fund (stability)

- Mid-cap fund (growth potential)

- Small-cap fund (high risk, high reward)

- Value or factor-based fund (contrarian returns)

- International / Global exposure (diversification beyond India)

This doesn’t mean you must buy 5 funds. It means your portfolio should cover multiple return drivers.

Ideal number of funds for most investors:

- 2–3 funds are enough for beginners

- 3–4 funds are enough for most goal-based SIPs

- Avoid holding 7–10 funds, it becomes unmanageable

3) The “3” in 7 5 3 1 Rule: Prepare for 3 Emotional Market Phases

This is the most underrated part. Markets don’t move in a straight line. A SIP journey has phases where you feel like a genius. and phases where you feel like quitting.

The “3” reminds you to stay disciplined across three return phases investors commonly experience:

- Phase 1: Low/Flat returns – You invest regularly but the portfolio seems stuck.

- Phase 2: Negative returns / market crash – Your SIP value falls, fear increases, headlines scare you.

- Phase 3: Strong returns (bull market) – Your portfolio grows rapidly, confidence returns.

Most people stop in Phase 2. which is exactly where long-term winners continue investing.

The SIP truth: The best SIP units are often bought during market falls.

4) The “1” in 7 5 3 1 Rule: Step-Up Your SIP Every Year

The “1” means: increase your SIP amount at least once every year. Even a small step-up can create a big difference over 10–15 years because it boosts your contribution and compounding base.

Example of a step-up plan:

- Year 1 SIP: ₹5,000/month

- Year 2 SIP: ₹5,500/month

- Year 3 SIP: ₹6,000/month

- Continue increasing by 10% annually

This habit is one of the most reliable “wealth boosters” in SIP investing.

You can also plan your SIP mutual fund investment using our SIP calculator with inflation tool. It will help you to know the complete return and compare with inflation.

7 5 3 1 Rule Summary (Quick SIP Cheat Sheet)

| Number | Meaning in SIP Rule | What You Should Do | Why It Matters |

| 7 | Minimum investment period | Commit to 7+ years | Gives time for compounding and recovery |

| 5 | Portfolio diversification | Invest across 3–5 categories | Reduces risk, improves stability |

| 3 | Market return phases | Stay calm during flat/negative phases | Prevents panic exits |

| 1 | Annual SIP step-up | Increase SIP yearly | Boosts final corpus significantly |

How to Apply 7 5 3 1 Rule in SIP (Step-by-Step Plan)?

Step 1: Set a Goal and Time Horizon

Before selecting funds, decide your goal:

- Wealth creation

- House down payment

- Child education

- Retirement corpus

Then match the time horizon (7+ years is ideal).

Step 2: Select Funds That Cover Multiple Categories

Build a balanced SIP set such as:

- 1 Flexi-cap or Large-cap

- 1 Mid-cap (optional)

- 1 Small-cap (optional for high risk appetite)

Step 3: Automate SIP + Automate Step-Up

Set SIP auto-pay and schedule annual increase.

Step 4: Stay Invested Through All Market Phases

Do not stop SIP during corrections. Review calmly once or twice a year.

What is the Golden Rule of SIP?

If you ask me as a mutual fund strategy expert, the golden rule of SIP is:

Start early, stay consistent, and keep increasing your SIP as your income grows.

It’s not about timing the market. It’s about time in the market. The 7 5 3 1 Rule is basically a structured version of this golden rule, turning it into a practical action plan.

How to Make 1 Crore in 5 Years in SIP? (Reality Check)

This is a popular question, but here’s the truth:

Building ₹1 crore in just 5 years through SIP is very difficult unless you invest a very large amount monthly or you get unusually high returns.

To understand why, think of the math:

- 5 years = only 60 SIP installments

- Compounding is limited because the time is short

- You need aggressive contribution + strong returns

For many realistic scenarios, reaching ₹1 crore in 5 years might require:

- ₹1,00,000+ per month SIP (approximate) depending on returns

- Or a mix of SIP + lump sum investment

Expert perspective: If your goal is ₹1 crore, a 7–12 year horizon is more SIP-friendly and achievable.

Which SIP Gives 30% Return?

No SIP can promise a 30% return because returns depend on market performance.

However, in some periods, equity-oriented categories like:

- Small-cap funds

- Mid-cap funds

- Thematic sector funds

may deliver 30%+ returns in strong bull markets. But they can also fall sharply in bad phases.

So if someone says “this SIP gives 30% return”, treat it as a marketing claim, not a guarantee.

What you should do instead:

- Choose funds based on goal + risk appetite

- Track consistency across cycles, not just 1-year return

Is Government Bond Better Than FD?

This depends on your goal: safety, return, liquidity, and taxation.

Government Bonds (G-Secs)

Pros:

- Backed by the Government (high safety)

- Potential for better yields than FD in some cycles

Cons: - Price can fluctuate if sold before maturity

- Interest rate risk exists

Fixed Deposit (FD)

Pros:

- Simple, stable, predictable

- Easy liquidity options

Cons: - Returns may not beat inflation

- FD interest is taxable as per slab

Expert conclusion:

- For pure simplicity: FD works

- For long-term predictable planning: government bonds can be attractive

- For inflation-beating potential: equity mutual funds (with 7+ years horizon) have historically been stronger

Common Mistakes Investors Make While Following 7 5 3 1 Rule

Even a good rule fails if execution is wrong. Avoid these mistakes:

- Investing for less than 3 years and expecting “big returns”

- Buying 6–8 funds and calling it diversification

- Stopping SIP during crashes

- Not stepping up SIP even after salary increases

- Ignoring asset allocation and putting everything into equity

FAQs on 7 5 3 1 Rule in SIP

1. Is the 7 5 3 1 Rule suitable for beginners?

- Yes, It is one of the easiest frameworks for beginners because it focuses on discipline, diversification, and long-term investing.

2. Can I follow the 7 5 3 1 Rule with just one mutual fund?

- You can start with one fund, but ideally you should diversify across at least 2–3 categories to reduce risk.

3. Does the 7-year rule mean I cannot withdraw before 7 years?

- You can withdraw anytime, but the rule is designed for better probability of stronger returns by staying invested long-term.

4. What is the best SIP amount to start with?

- Start with what you can sustain comfortably, even ₹500 or ₹1,000. The key is consistency and annual step-up.

5. How much should I increase SIP every year?

- A common step-up is 10% yearly. Even 5% is helpful if your income growth is slower.

6. Should I stop SIP when markets are at all-time high?

- No, SIPs are designed to work across market levels. Stopping SIP based on “high market” thinking often leads to missed compounding.

7. Is the 7 5 3 1 Rule only for equity mutual funds?

- It is mainly designed for equity SIP wealth creation, but diversification logic can apply to balanced portfolios too.

Final Thoughts

The 7 5 3 1 Rule in SIP is not a shortcut to wealth, but it is a smart, realistic framework that can massively improve your long-term investment outcome. By committing to at least 7 years, you give your money the time it needs to recover from volatility and grow through compounding. By diversifying across 5 categories, you reduce dependence on one style or market cycle and create a stronger portfolio foundation.

By preparing for the 3 emotional phases of investing, you prevent panic exits and avoid the most common SIP mistake: stopping at the worst time. And finally, by increasing your SIP at least 1 time every year, you align your investing journey with inflation, income growth, and bigger future goals.

If you want SIP success, you don’t need secret tips or unrealistic “30% return promises.” You need discipline, patience, and a repeatable system. Follow this rule honestly, review your portfolio calmly, and give the process enough time. In the long run, the 7 5 3 1 Rule can turn a simple SIP into a powerful wealth machine for your future. If you want, I can also create a sample 7-5-3-1 SIP portfolio allocation for different risk levels (beginner, moderate, aggressive) with clean fund-category logic.

Tags: What is the golden rule of SIP? How to make 1 crore in 5 years in SIP? Which SIP gives 30% return? Is government bond better than FD? 7 5 3 1 rule in sip in hindi, 7 5 3 1 rule in sip pdf, 7 5 3 1 rule in sip calculator, 7-5-3-1 rule Mutual Fund.