Is SWP Better than FD: Hello my fellow indian citizens. First of all, welcome to my mutual fund guide site. I know you are totally confused between fd and swp mutual funds for your investment. For senior citizens in 2026, the biggest financial question is no longer just about saving money but about generating steady, tax-efficient, and inflation-beating income after retirement. With rising healthcare costs, longer life expectancy, and fluctuating interest rates, retirees are actively asking: Is SWP better than FD?

Fixed Deposits (FDs) have traditionally been the first choice for retirees due to safety and predictability. However, Systematic Withdrawal Plans (SWPs) from mutual funds are increasingly gaining attention as a smarter alternative for long-term retirement income. This article takes a deep, expert-level look at SWP vs FD retirement income, addressing real concerns senior citizens face today.

By the end, you will have a clear answer to what is better, FD or SWP, backed by logic, data, and retirement-focused insights. Okay, let’s get into the topic below.

Also Check: SWP Early Retirement Strategy

Understanding the Basics – FD vs SWP Explained Simply

What is a Fixed Deposit (FD)?

A Fixed Deposit is a traditional investment where you deposit a lump sum with a bank or NBFC for a fixed tenure at a predetermined interest rate. You receive interest either monthly, quarterly, or at maturity.

Key features of FD:

- Capital protection (up to insurance limits)

- Fixed and predictable interest

- Simple and easy to understand

- Fully taxable interest income

What is a Systematic Withdrawal Plan (SWP)?

An SWP allows investors to withdraw a fixed amount regularly from their mutual fund investments. The remaining corpus stays invested and continues to grow depending on market performance.

Key features of SWP:

- Customizable withdrawal amount and frequency

- Partial market exposure for growth

- Better tax efficiency

- Suitable for long retirement horizons

Why the Question “Is SWP Better than FD?” Matters More in 2026

In 2026, interest rates are relatively moderate, inflation remains sticky, and senior citizens are living longer than ever. Relying only on fixed income instruments can silently erode purchasing power.

Here is why retirees are re-evaluating FDs:

- Real FD returns after tax often fall below inflation

- Interest income is taxed every year

- No growth element to fight rising expenses

This is exactly where SWPs enter the conversation.

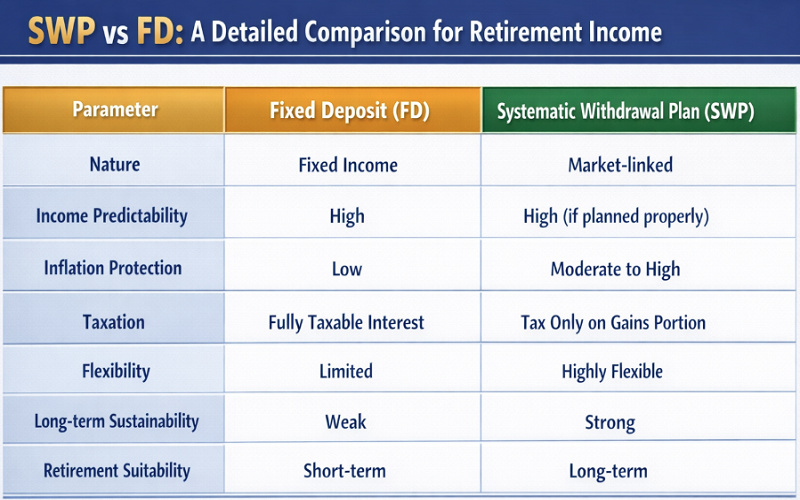

SWP vs FD – A Detailed Comparison for Retirement Income

| Parameter | Fixed Deposit (FD) | Systematic Withdrawal Plan (SWP) |

| Nature | Fixed income | Market-linked |

| Income predictability | High | High (if planned properly) |

| Inflation protection | Low | Moderate to High |

| Taxation | Fully taxable interest | Tax only on gains portion |

| Flexibility | Limited | Highly flexible |

| Long-term sustainability | Weak | Strong |

| Retirement suitability | Short-term | Long-term |

From a retirement planning lens, SWP vs FD retirement income is not about safety versus risk, but about longevity and efficiency.

What is Better, FD or SWP for Senior Citizens?

The answer depends on time horizon, tax bracket, and income needs.

FD is better when:

- You need money for less than 2–3 years

- You want zero market exposure

- You are in a very low tax bracket

- Capital safety is the only priority

SWP is better when:

- Retirement horizon is 10–25 years

- You want inflation-adjusted income

- You are in a higher tax slab

- You want to preserve capital while withdrawing

For most retirees in 2026, SWP is better than FD for senior citizens when planned correctly. Watch the below video to get the complete knowledge of both swp and fd.

What is the Average Return in SWP?

One of the most common concerns retirees have is: what is the average return in SWP?

Important clarification: SWP itself does not generate returns. Returns depend on the mutual fund chosen.

Typical long-term average returns:

- Conservative hybrid funds: 7–9%

- Balanced advantage funds: 8–10%

- Equity-oriented hybrid funds: 9–11%

If withdrawals are kept within sustainable limits (5–7%), SWP can provide income without exhausting capital, something FDs struggle to achieve over long periods. Using our swp calculator with inflation tool you can easily plan your mutual fund investment.

Which Bank Gives 9.5 Interest on FD in 2026?

Many retirees search for high FD rates and ask: which bank gives 9.5 interest on FD?

Reality check for 2026:

- Large public and private banks rarely offer 9.5%

- Some small finance banks or special senior citizen schemes may temporarily offer higher rates

- Higher rates often come with higher risk or shorter tenures

Even if a senior citizen gets 9.5%:

- Interest is fully taxable

- Post-tax return may drop to 6–6.5%

- Inflation further reduces real income

This is why high FD rates alone should not be the deciding factor.

Is 12% Return Realistic in Retirement Planning?

Another frequent question is: is 12% return realistic?

Expert answer:

- 12% annual return is not guaranteed and should never be assumed for safe retirement planning

- It is possible in equity-heavy portfolios over long periods

- It is not suitable as a base assumption for conservative retirees

For SWP planning, professionals typically assume:

- 8–10% long-term returns

- 5–6% withdrawal rate

This conservative approach ensures income stability and capital preservation.

Tax Efficiency: The Hidden Advantage of SWP Over FD

Taxation is where SWP truly outperforms FD.

FD Taxation:

- Entire interest is taxed every year

- Tax slab based

- No deferral benefit

SWP Taxation:

- Only the gains portion of withdrawal is taxed

- Long-term capital gains taxed at lower rates

- Initial withdrawals are mostly principal, reducing tax outgo

Over 15–20 years, this tax efficiency can significantly boost post-tax retirement income.

SWP vs FD for Senior Citizens: Real-Life Retirement Scenario

Imagine a retiree with ₹1 crore corpus.

FD scenario:

- 7% interest

- Annual income: ₹7 lakh

- Taxable every year

- Capital remains static

- Purchasing power declines

SWP scenario:

- 9% portfolio return

- 6% annual withdrawal

- Annual income: ₹6 lakh

- Lower tax

- Remaining corpus continues to grow

Over time, SWP not only matches income needs but also protects against inflation, making SWP better than FD in 2026 for long-term retirees.

Common Mistakes Senior Citizens Make with SWP

To fairly answer is SWP better than FD, risks must be acknowledged.

Avoid these mistakes:

- Withdrawing too aggressively

- Choosing pure equity funds without planning

- Ignoring asset allocation

- Not reviewing SWP annually

When managed professionally, these risks can be minimized.

FAQs on Is SWP Better Than FD?

1. Is SWP better than FD for senior citizens?

- Yes, for long-term retirement income, SWP is generally better due to tax efficiency, flexibility, and inflation protection.

2. What is better, FD or SWP?

- FD is better for short-term safety. SWP is better for long-term income sustainability.

3. What is the average return in SWP?

- Average long-term returns range between 8–10% depending on fund type and market conditions.

4. Which bank gives 9.5 interest on FD?

- Only select small finance banks or special schemes may offer such rates temporarily.

5. Is 12% return realistic for SWP?

- No, 12% should not be assumed for retirement planning. Conservative estimates are safer.

6. Is SWP risky for retirees?

- SWP carries market risk, but with hybrid funds and controlled withdrawals, risk is manageable.

Final Thoughts

For senior citizens planning retirement income in 2026, the question “is SWP better than FD” deserves a nuanced answer rather than a one-size-fits-all response. Fixed Deposits still play an important role in providing short-term stability and peace of mind, especially for emergency funds or very conservative investors.

However, relying solely on FDs for a 20- to 30-year retirement can quietly damage financial security due to inflation, taxation, and limited growth. Systematic Withdrawal Plans, when designed using conservative or hybrid mutual funds, offer a far more efficient solution for long-term income.

They combine predictable cash flow, superior tax treatment, flexibility, and the ability to preserve purchasing power over time. For most retirees, especially those in higher tax brackets and with longer life expectancy, SWP is better than FD for senior citizens from a sustainability and wealth-preservation perspective.

The smartest retirement strategy in 2026 is not choosing one over the other blindly, but using FDs for short-term safety and SWPs for long-term income growth. When planned thoughtfully, SWP emerges as the clear winner for modern retirement income planning. I hope the above guide will help you to know more about fd and swp mutual funds. If you still have any queries related to your investment please feel free to contact us. We are always ready to provide a proper finance solutions as soon as possible. Follow this site for more mutual fund updates thanks for your visit.

Tags: What is better, FD or SWP? What is the average return in SWP? Which bank gives 9.5 interest on FD? Is 12% return realistic? SWP vs FD retirement income, is swp better than fd for senior citizens?