IDCW vs SWP: Hello my dear investers, First of all, welcome to my site. Are you getting confused to choose between swp and idcw for your retirement income? Then you are in a right place. Choosing the right option for regular income from mutual funds is one of the most misunderstood areas in personal finance. Many investors, especially retirees and those seeking monthly cash flow, often get confused between IDCW vs SWP. At first glance, both seem to serve the same purpose: providing periodic income from mutual fund investments. But in reality, the difference between IDCW and SWP is much deeper, particularly when it comes to tax efficiency, predictability, long-term wealth preservation, and retirement suitability.

In this expert-level guide, we will break down IDCW vs SWP, compare them side by side, analyze taxation, highlight risks, and help you clearly decide which is better, SWP or dividend, based on real-world investing logic rather than marketing narratives.

What Is IDCW in Mutual Funds?

IDCW stands for Income Distribution cum Capital Withdrawal. Earlier, it was popularly known as the dividend option, but the terminology was changed to make investors aware of an important fact: dividends are not free income.

How IDCW Works?

- The mutual fund distributes income to investors from:

- Realized profits, or

- Investor’s own capital (NAV reduces)

- Payouts can be monthly, quarterly, or irregular

- The fund house decides when and how much to pay

Key Characteristics of IDCW

- No fixed income amount

- NAV reduces after each payout

- Income depends on market performance and fund decisions

- Investor has no control over timing or amount

This is where the first major difference between IDCW and SWP begins.

What Is SWP (Systematic Withdrawal Plan)?

A Systematic Withdrawal Plan (SWP) allows investors to withdraw a fixed, pre-decided amount from their mutual fund investment at regular intervals.

How SWP Works?

- Investor decides:

- Withdrawal amount

- Frequency (monthly, quarterly, etc.)

- Units are redeemed systematically

- Remaining investment continues to grow

Key Characteristics of SWP

- Predictable and stable income

- Full control with the investor

- Taxed only on capital gains portion

- Ideal for retirement income planning

This makes SWP vs IDCW a crucial comparison for anyone seeking long-term income. To calculate your swp investment use our calculator here.

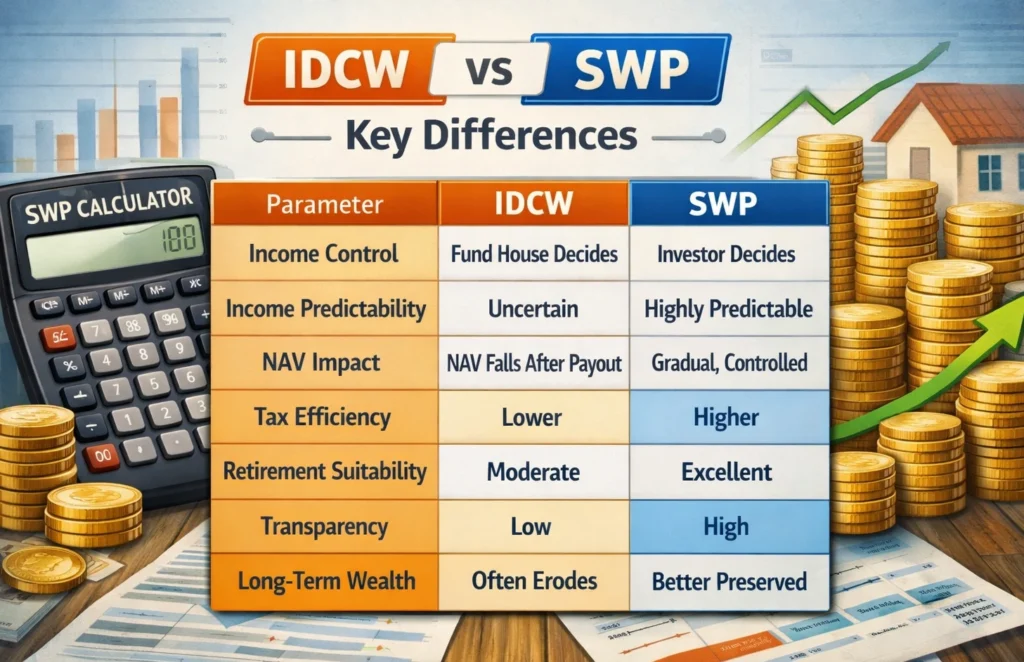

IDCW vs SWP: Key Differences at a Glance

| Parameter | IDCW | SWP |

| Income control | Fund house decides | Investor decides |

| Income predictability | Uncertain | Highly predictable |

| NAV impact | NAV falls after payout | Gradual, controlled |

| Tax efficiency | Lower | Higher |

| Retirement suitability | Moderate | Excellent |

| Transparency | Low | High |

| Long-term wealth | Often erodes | Better preserved |

This table alone explains why many experts lean towards SWP for disciplined income.

IDCW vs SWP Taxation Explained in Simple Terms

Taxation is the biggest deciding factor when comparing idcw vs swp taxation.

Taxation of IDCW

- IDCW is fully taxable in the investor’s hands

- Added to total income and taxed as per slab

- No indexation benefits

- High-income investors lose a significant portion to tax

Example: If you receive ₹1,00,000 as IDCW and fall under the 30% tax slab, you pay ₹30,000 as tax.

Taxation of SWP

- Only the capital gains portion is taxed

- Principal withdrawal is tax-free

- Equity and debt funds have different tax rules

- Long-term gains are taxed at lower rates

Example: If ₹1,00,000 SWP includes ₹70,000 principal and ₹30,000 gains, tax applies only on ₹30,000.

This clearly shows SWP is more tax efficient than IDCW, especially for retirees.

Which Is Better, SWP or Dividend for Monthly Income?

Let’s answer the most searched question directly: Which is better, SWP or dividend?

Why SWP Wins for Monthly Income?

- Fixed and predictable cash flow

- Better control during market volatility

- Lower tax burden

- Can be aligned with inflation using step-up withdrawals.

Also check: Best SWP plans to invest in 2026

When IDCW May Be Considered

- Investors in lower tax brackets

- Short-term income needs

- Those who don’t want to actively manage withdrawals

For most long-term income seekers, SWP clearly outperforms IDCW.

IDCW and SWP Difference for Retirement Planning

Retirement planning demands certainty, tax efficiency, and sustainability.

Is IDCW Good for Retirement?

IDCW has some serious drawbacks for retirees:

- Irregular payouts

- No guarantee of monthly income

- NAV erosion risk

- Tax inefficiency over long periods

Why SWP Is Ideal for Retirement?

- Monthly income like a salary

- Can be structured conservatively

- Allows portfolio to grow even during withdrawals

- Works well with hybrid and equity funds

This is why most retirement-focused advisors recommend SWP over IDCW.

What Are the Disadvantages of IDCW?

Understanding the disadvantages is critical before choosing IDCW.

Major Drawbacks of IDCW

- Income is not guaranteed

- NAV reduces after every payout

- Taxed at slab rates

- Creates illusion of “free income”

- Poor transparency

Many investors mistakenly assume IDCW is extra income, while in reality, it often comes from their own investment.

SWP vs IDCW: Impact on Long-Term Wealth

IDCW Impact

- Reduces compounding potential

- Encourages consumption mindset

- Less efficient during volatile markets

SWP Impact

- Allows remaining corpus to compound

- More flexible withdrawal strategy

- Better capital preservation

Over a 15–20 year horizon, SWP can leave investors with significantly higher residual wealth compared to IDCW.

Which Option Is Better for High Tax Bracket Investors?

If you fall under:

- 20% tax slab

- 30% tax slab

Then SWP is almost always better than IDCW.

Why?

- Lower effective tax rate

- Control over timing of withdrawals

- Ability to manage capital gains smartly

This makes swp vs idcw a no-brainer for high-income professionals and retirees.

Common Myths about IDCW and SWP

Myth 1: IDCW gives free income

Reality: It reduces NAV and capital.

Myth 2: SWP is risky

Reality: Risk depends on fund selection, not SWP itself.

Myth 3: IDCW is better in falling markets

Reality: IDCW payouts may stop entirely during downturns.

FAQs on IDCW vs SWP

1. IDCW vs SWP which is better for monthly income?

- SWP is better due to predictable income and tax efficiency.

2. IDCW vs SWP taxation: which saves more tax?

- SWP saves more tax because only gains are taxed.

3. Is IDCW good for retirement?

- Not ideal. SWP is better suited for retirement income.

4. What is the main difference between IDCW and SWP?

- Control and taxation. IDCW is fund-driven, SWP is investor-driven.

5. Can SWP run out of money?

- Yes, if withdrawals are too high, but proper planning prevents this.

Final Verdict: IDCW vs SWP – Which Should You Choose?

When it comes to IDCW vs SWP, the answer becomes very clear once you move beyond surface-level comparisons. IDCW may look simple and passive, but it lacks transparency, tax efficiency, and income predictability. Its biggest drawback is that investors do not control the payout amount or timing, and the income received is fully taxable, often eating into long-term wealth. This makes IDCW less suitable for serious income planning, especially during retirement years when stability matters most.

On the other hand, SWP offers structured, predictable, and customizable income. It allows investors to withdraw only what they need, pay tax only on the gains portion, and let the remaining corpus continue compounding.

Over long investment horizons, SWP not only provides smoother cash flow but also preserves capital far better than IDCW. For retirees, high-tax-bracket investors, and anyone planning monthly income with discipline, SWP is clearly the more tax-efficient, flexible, and future-proof choice. If your goal is sustainable income without sacrificing long-term financial health, SWP stands out as the smarter strategy.

I hope the above guide will help you to know more about IDCW and SWP mutual fund. Now you can choose your best investment plans. If you still have any questions on mutual fund plans please feel free to contact us. We are always ready to help you. Follow this site for more finance and investment tips, Thanks for your visit.

Tags: idcw vs swp which is better, idcw vs swp taxation, Which is better, SWP or dividend? What are the disadvantages of IDCW? Is IDCW good for retirement? idcw and swp difference, swp vs idcw, difference between idcw and swp.